Can I Use the Same Set of Notarized Documents for Both NRE/NRO Account and NR Demat Account?

Ashish Jha

Co-Founder

Jan 9, 2025

Managing your finances as an NRI in India can sometimes feel like juggling multiple tasks. With the various account types, regulations, and endless paperwork, it’s easy to feel overwhelmed. One common question that arises is whether you can use the same notarized documents for different financial accounts, specifically for your NRE/NRO accounts and your NR Demat account.

So, what’s the answer? Can you use the same documents, or do you need separate ones for each? Let’s break it down in a simple and straightforward way.

Quick Recap: What Are NRE, NRO, and NR Demat Accounts?

First, let’s get on the same page about what these accounts are. Knowing their purpose will make everything else fall into place.

NRE (Non-Resident External) Account

Think of this as your go-to account for managing money earned abroad. Here’s why it’s a favorite:

You deposit funds in foreign currency, but it gets converted to Indian rupees.

Both the money you put in and the interest you earn can be sent back abroad anytime—tax-free.

NRO (Non-Resident Ordinary) Account

This account helps you handle income earned in India—like rent, dividends, or pension. Key highlights include:

It’s in Indian currency.

While the interest earned can be repatriated, sending the principal amount abroad is capped and taxed.

NR Demat Account

Want to invest in the Indian stock market? You’ll need a Demat account. This digital account holds your shares and securities. It’s linked to either an NRE or NRO account, depending on whether you want your investments to be repatriable or not.

The Big Question: Can You Use the Same Documents?

Now, let's get to the big question—can you use the same set of notarized documents for both your NRE/NRO account and your Demat account? The short answer is it depends. Let’s break it down so you can understand exactly why this is the case and how to make the process easier for yourself.

Why Do Different Institutions Require Separate Copies?

Each institution follows its own protocol and keeps its own records, so they both require their own copies of the notarized documents. If you send a notarized passport copy to your bank for the NRE or NRO account, the bank will need a physical copy in their file. Likewise, the broker will also want their own physical copy for your Demat account.

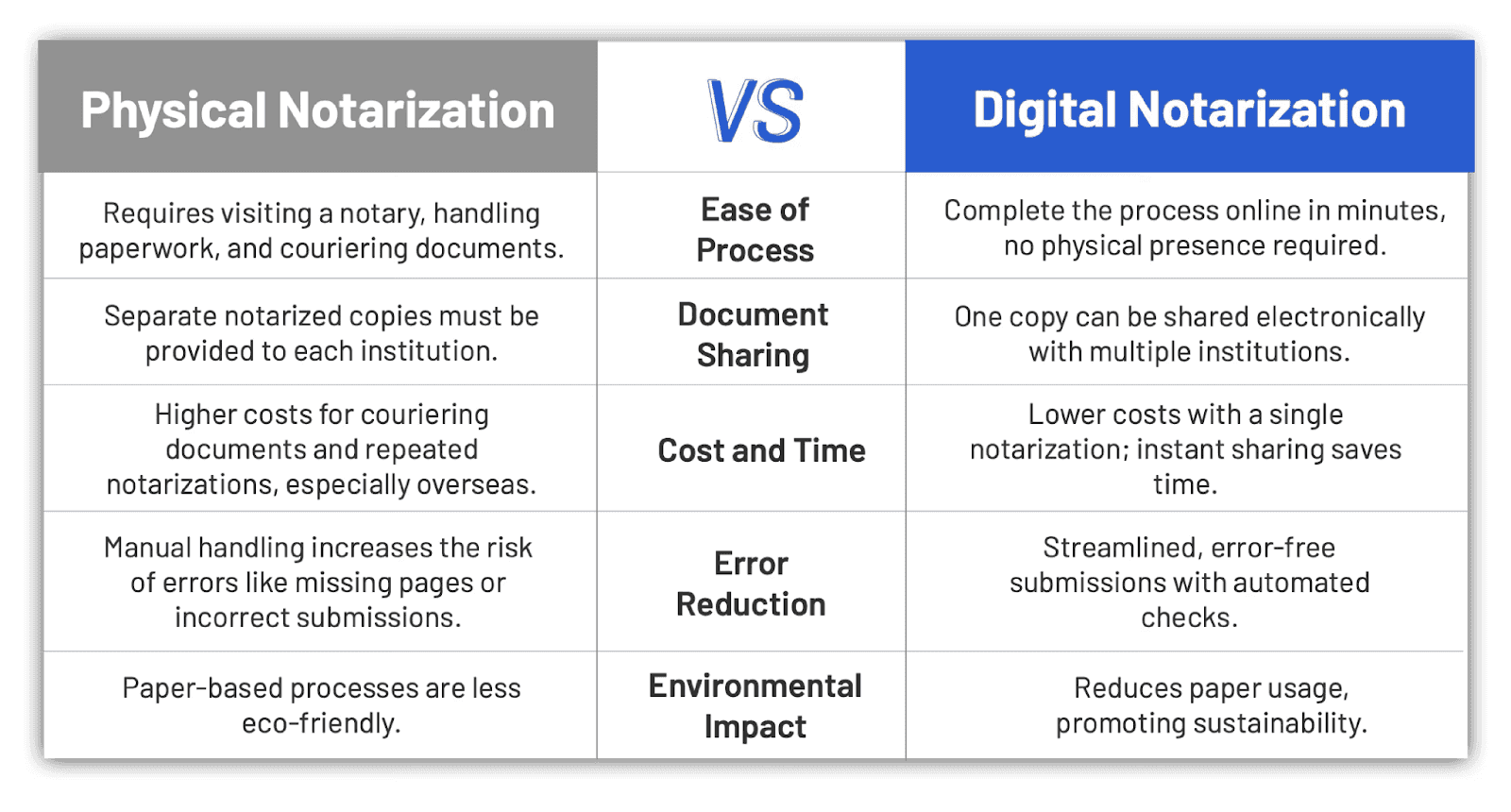

The Difference With Digital Notarization

Digital notarization makes the process much simpler. It involves notarizing documents electronically, so there’s no need for physical copies. Since the notarized document is in a digital format, you can easily share the same copy with multiple institutions.

For example, if your passport is digitally notarized, you can use that one copy for both your bank (for NRE/NRO accounts) and your broker (for your Demat account). This means you won’t need separate copies for each account application—just one digital copy that works for both.

Digital notarization not only saves time by removing the hassle of getting separate notarizations for each institution but also reduces costs, especially when managing documents abroad.

Conclusion: Simplifying Your NRI Financial Journey

In conclusion, while the same physical notarized documents can't always be used for both NRE/NRO and Demat accounts due to separate submissions, digital notarization makes things much easier. You can use the same document across multiple institutions, saving time, money, and minimizing errors. Whether applying for an NRE account or setting up a Demat account, digital notarization simplifies the process, allowing you to focus on managing your finances and investments in India without stress.